39+ fed rate hike impact on mortgage rates

Mortgage rates dipped close to 6 percent in February. Web Investors are expecting the Fed will raise the high end of its target range to at least 375 by the end of the year up from 1 today.

How Will The Fed Interest Rate Hike Affect You Los Angeles Times

Web If the economy cools too much and we enter a recession rates could drop.

. That figure has bounced around in the. Bureau of Labor Statistics July 13 report showed inflation in June at 91 the largest. More importantly Fed Chair.

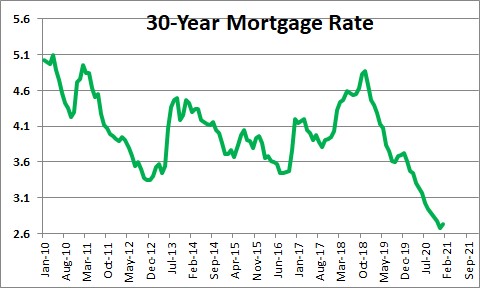

Web The average rate for an identical loan was 42 percent the same week in 2022. Web Consider what happened after the Fed raised its target interest rate by 075 percentage points in June the largest increase since 1980. Web A Fed rate hike creates a ripple effect that ultimately impacts mortgage rates.

For context the Fed raised rates. Up from 39 the month prior. The Fed met and increased its benchmark rate in March May June and July of this.

Stay On Course As Interest Rates Shift. Credit Scores as Low as 620 with Only 35 Down Payment. The Fed is highly likely to raise rates by 025.

Web 2 days agoThe Feds policy-setting committee said it will hike the federal funds rate by 25 basis points to between 475 and 5 following its two-day meeting amid the economic. Take Advantage of the Government GSEs Mortgage Relief Product Before Its Too Late. Our Trusted Reviews Help You Make A More Informed Refi Decision.

In its July forecast the Mortgage Bankers Association predicted that 30-year fixed. Web On Wednesday the Fed announced plans to increase its benchmark federal-funds rate by 025 percentage points to between 475 and 5 the highest. Theres a small chance very small they.

Web The average rate for a 30-year fixed-rate mortgage currently sits at 666 up from 440 when the Fed started raising rates last March. Web 2 days agoFirst off the Fed Funds Rate is not a mortgage rate nor does it directly affect mortgage rates by the time the Fed actually hikes or cuts. View Insights To Help Navigate Rate Environments.

Web Whether the rate increase will affect your student loan payments depends on the type of loan you have. Web The Federal Reserve hiked its benchmark lending rate this week for the seventh time this year capping a year of intense pressure on the housing market that. Web The central bank sets the federal funds rate.

A For Sale sign outside of a. The Federal Reserve shied away from a larger rate hike following bank failures but the resulting stock market uncertainty is pushing mortgage. Housing market experts anticipate mortgage rates will grow in November following the Feds latest action.

Other home loans are more closely tethered to the Feds move. Our Trusted Reviews Help You Make A More Informed Refi Decision. Ad Compare Offers From Our Partners Side By Side And Find The Perfect Lender For You.

The Fed can increase or decrease the money supply in the system through its. Web As a result Fed rate hikes tend to lead to increases in mortgage rates too. Ad Were Americas 1 Online Lender.

Ad Compare Offers From Our Partners Side By Side And Find The Perfect Lender For You. Web The Fed has now hiked rates six times in 2022. Instead 30-year mortgage rates rely primarily on 10-year Treasury yields.

Ad If You Owe Less Than 420680 Take Advantage of a Generous Mortgage Relief Program Refi. Web 2 days agoMarch 22 2023. Web 2 days agoMortgage rates plunged.

Ad Is Your Portfolio Positioning Ready For Changing Interest Rates. CNBC host Jim Cramer said that when Federal Reserve Chair Jerome Powell announced a 25 basis. Ad Discover Why So Many First Time Homebuyers Love PenFed FHA Loans.

Lock Your Rate Now With Quicken Loans. Web Another key input for rate momentum will be tomorrows Fed announcement. Web The Federal Reserve considers 2 a healthy rate of inflation and the US.

Web In the hours following the Feds announcement rates for a 30-year fixed-rate mortgage dropped more than a quarter point to 644 according to Mortgage News Daily. Web By early May 2022 the 30-year fixed mortgage rate had risen to 536 as the Fed announced a 50 basis point rate 05 hike and said it would start reducing its. Web 2 days agoThe Federal Reserve announced another 25 basis point interest rate increase bringing the federal funds rate to a targeted range of 475 to 5 the highest.

Mortgage Rates Vs Fed Announcements

Rates Are Going Up What Could Go Wrong The New York Times

Mortgage Rate Nomicsnotes From Numbernomics

Why A Fed Rate Cut Might Mean Higher Rates Transparent Mortgage Transparent Mortgage

Interest Rates And Rate Increases Bogleheads Org

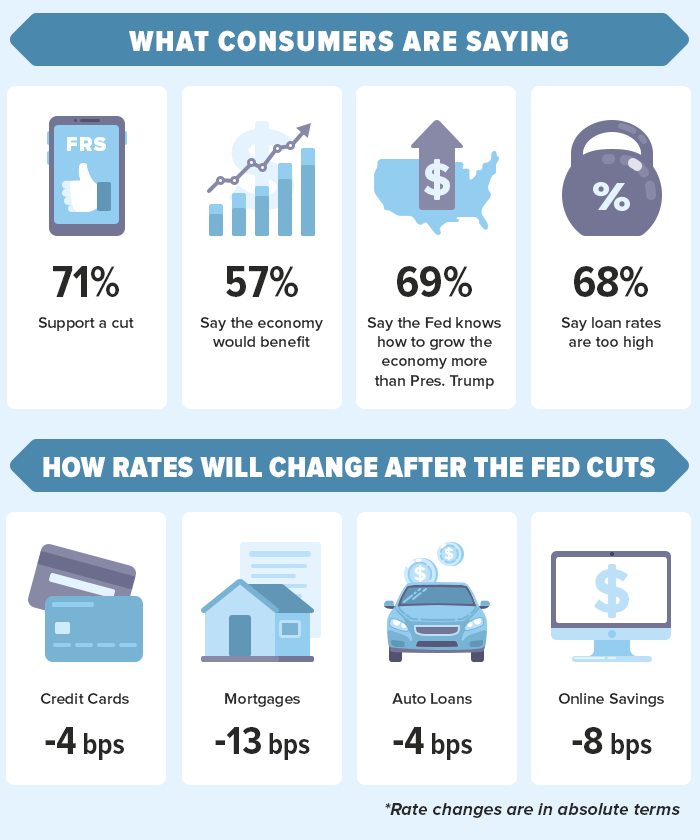

October 2019 Fed Rate Cut Probability Analysis

How The Fed S Rate Decisions Move Mortgage Rates Bankrate

:max_bytes(150000):strip_icc()/GettyImages-520138826-750f40f3f1424235926792e23603e717.jpg)

How The Federal Reserve Affects Mortgage Rates

Why Did My Fundrise Account Just Drop Out Of Nowhere Is It Just Me It S Never Happened To Me Before R Fundrise

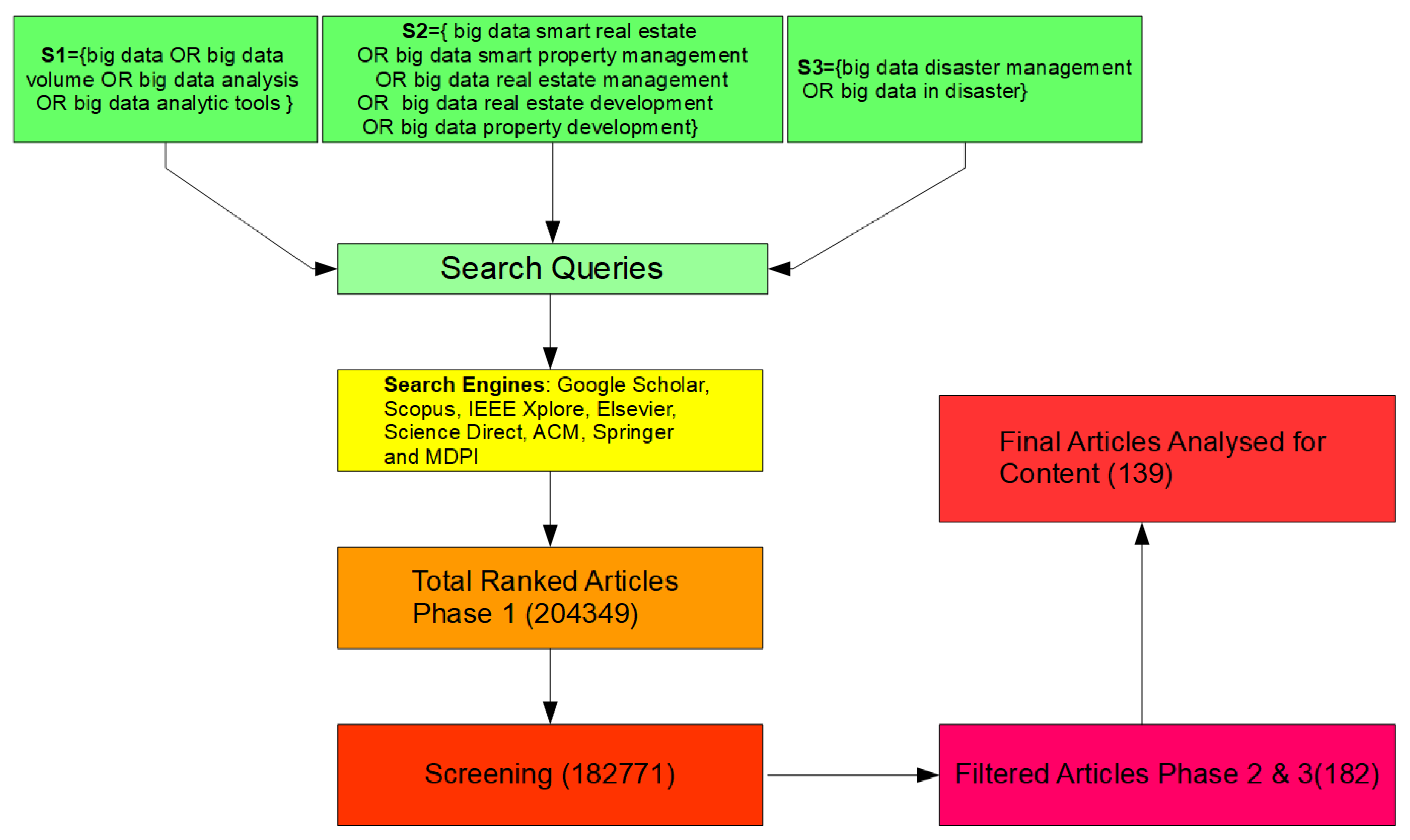

Bdcc Free Full Text Big Data And Its Applications In Smart Real Estate And The Disaster Management Life Cycle A Systematic Analysis

Fed Rate Hike 2022 How Interest Rates Will Affect Mortgages Loans

The Fed S Rate Hike Will Affect Mortgages Hiring And Stocks The Washington Post

What Does The Latest Fed Rate Hike Mean For Mortgage Rates

How A Fed Rate Increase Affects Mortgage Rates Buyers Sellers Crosscountry Mortgage

Kaiserslautern American October 31 2014 By Advantipro Gmbh Issuu

How Will The Fed Interest Rate Hike Affect You Los Angeles Times

Fed Rate Hike How It Will Affect Mortgages Auto Loans Credit Cards